One of the available tools in cultural policy at the national level includes the reduction of VAT rates for cultural goods and services. Governments can decide, for instance, to lower the VAT rate for books to encourage reading and literacy. These indirect fiscal incentives receive however very little attention both at policy level as well as by the public. To remedy that, we document the standard and reduced VAT rates in European Union member states in the period from 1993 to 2013 and explored the underlying determinants. The results point at the existence of clear fundamental drivers of the standard VAT rates. However, when it comes to the reduced cultural taxes, we fail to find any correlates – it is as if the decision-making was done in a random-like process. This supports the concern that there is no clear directive on how to efficiently design the reduced rates.

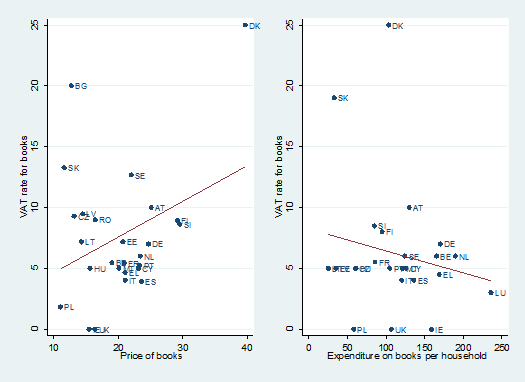

We further introduce a theoretical framework explaining how reduced fiscal rates are expected to decrease prices and increase quantities of the consumed cultural goods and services. We show that a decrease in the VAT rate for books by one percentage point is associated with an economically significant drop in the price of about 2.6 percent. Finally, we show the positive effect of a fiscal reduction on household’s book expenditure, where the results imply that a one percentage point decrease in the VAT rate for books leads to an increase in expenditure by about 2.7 percent.

We further introduce a theoretical framework explaining how reduced fiscal rates are expected to decrease prices and increase quantities of the consumed cultural goods and services. We show that a decrease in the VAT rate for books by one percentage point is associated with an economically significant drop in the price of about 2.6 percent. Finally, we show the positive effect of a fiscal reduction on household’s book expenditure, where the results imply that a one percentage point decrease in the VAT rate for books leads to an increase in expenditure by about 2.7 percent.

An improved understanding of the reduced cultural taxes will allow to effectively employ this policy in order to support consumption of, among others, the fast growing digital heritage markets, such as the e-books market. It has been actually the increased use of digital technology for the production, distribution and consumption of cultural goods and services that has raised questions regarding the VAT Directive. Due to the positive externalities associated with cultural consumption, markets fail to provide the optimum quantity of culture at the right price. Tax instruments are thus proposed as effective tools that can be used to change the quantities and prices, in order to tackle market failures. From a policy perspective, this suggests that a reduction in VAT rates can stimulate household consumption and consequently should be designed in conjunction with a national cultural policy.

Paper can be downloaded here.

The study is part of the FP7 EU funded project RICHES: Renewal, Innovation and Change: Heritage and European Society.

The authors:

Karol Jan Borowiecki, Associate Professor at the Department of Business and Economics, University of Southern Denmark, Odense, Denmark. E-mail: kjb@sam.sdu.dk (corresponding author).

Trilce Navarrete, Postdoc at the Department of Business and Economics, University of Southern Denmark, Odense, Denmark. E-mail: trilce.navarrete@gmail.com.